MINI-COURSE "The Mean-Reversion Trade"

In this Mini-Course you will get my favourite strategy:

“The Mean-Reversion Trade”.

I win more than 70% of these trades!

I give you this complete strategy for free.

So now YOU can enjoy these profitable trades too!

Why? To prove to you I am worth your time.

And that’s not all!

At the end of this Mini-Course you will get my Scanner.

(It scans the market for these trades).

Without further ado let’s get started.

Reversion to the mean

This Mean-Reversion Trade is like cherry picking. But before digging deeper into the trade’s strategy itself, I will first focus on the statistical phenomenon behind it.

Another word for mean is normal. What is normal? I focus on what is normal, in order to find what is abnormal. I am looking for extremes, for irrational price behaviour.

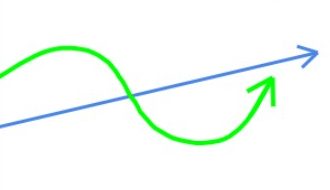

The statistical phenomenon I am referring to is the “reversion to the mean”.

This is about price moving away from averages at highs and lows, but eventually returning to the mean again.

Most of the time a coin moves within a particular range, be it up, down, or sideways.

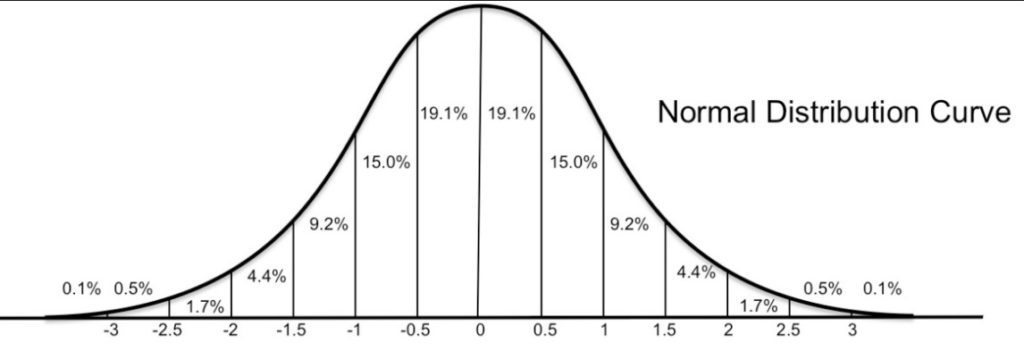

When price is normally distributed within this range, then you can expect deviations to reverse back to the average. As you also see this in the statistical concept of the normal distribution. At the middle of this bell shaped curve you’ll get the highest probability. At the edges you get the lowest probabilities.

The “normal” is that part of the measured data that occurs the most frequently.

On a price chart this means we have an average price, and price deviating above or below it. In uptrends it deviates more to the upside of the average, and in a downtrend more to the downside.

Crypto markets (and many other markets) aren’t really normally distributed.

Although it looks like that often. Price can deviate far more from the mean, than a statistical “standard deviation”. Crypto is a really volatile and unpredictable place. You never know what the market will do next, always keep that in mind.

But by filtering mean-reversion setups for strong and early trends you actually take advantage of the volatility, and get very high probability trading opportunities.

It is my favourite trade!

How do you trade this?

When price deviates from the mean, we have an opportunity to trade the reversion-to-the-mean. To trade such a mean-reversion, we need to know the average price over a previous period. How do you know the average in an up- or downtrend? By using the right moving average.

Using Technical Analysis you want to determine :

- Is this coin trending?

- Is it a strong trend?

- Is it still an early trend?

All this can be deduced by using the right moving average.

I prefer to use the 50 period Standard Moving Average (SMA50).

SMA50

As you might know, when going long you have the highest probability in an uptrending market. I recogize an uptrend by an upsloping SMA50. And when going short you have the highest probabilities in a downtrending market: a downsloping SMA50.

These reversion-to-the-mean trades, also called “mean reversions”, are my highest probability trades. These are the trades I love the most.

The general idea is to buy when price deviates to the downside, and sell when it deviates to the upside.

My mean-reversion method basics:

- Always trade towards the mean: buy below the SMA50, short above the SMA50.

- Only buy in uptrend, only short in downtrend.

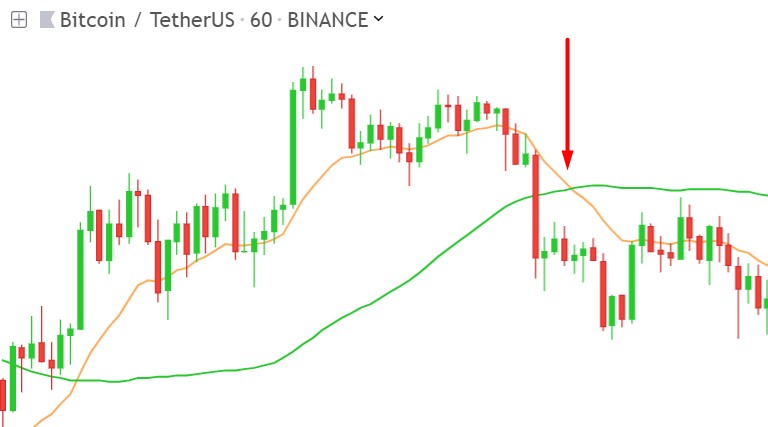

In the next chart example, the red bar stretched away from the mean, the green bar is the pullback back to the mean:

(the green line is the SMA50, the orange line is the EMA15)

To summarize these setups in practical terms: when going long you have a higher probability when you buy below the SMA50, when going short you have a higher probability when price is above the SMA50.

In a strong uptrend price moves well above the SMA50, while the SMA50 will be sloping upwards. The stronger the uptrend, the steeper the slope of the SMA50, and the further away price will move up from the SMA50. So when you see a steep upsloping SMA50, but price is below it, you know you have an abnormal situation that has deviated from the mean, and has a high probability (statistically) to return to the mean. This is the anomaly we look for.

Simple Rules

This gives me a simple set of trading rules. When buying a mean-reversion opportunity, you want:

- The SMA50 to be sloping up (a steeper angle means a stronger trend)

- Price to be below this moving average (often a fast drop below the mean, a fast bounce back to it, and a slow drop means a slow return)

It is very important that these conditions are still met at the moment of entry:

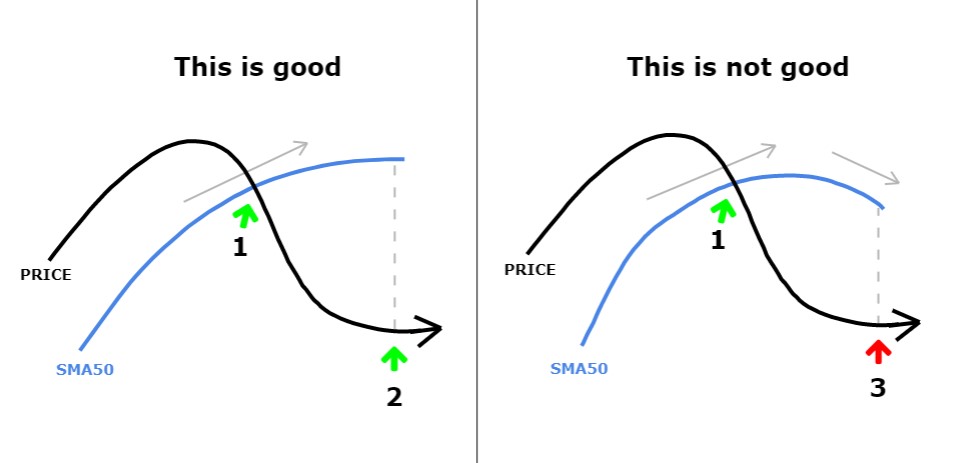

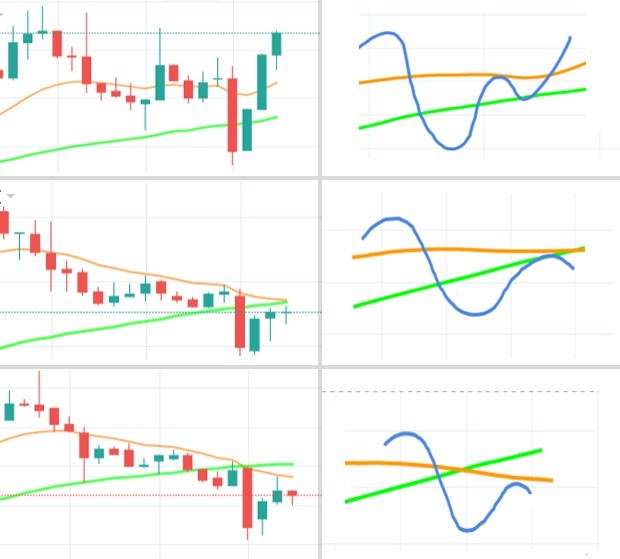

^^ THIS IS PROBABLY THE MOST IMPORTANT IMAGE IN THIS MINI-COURSE ^^

- Left example price drops below an upsloping SMA50 (1), and next at the bottom of the retracement the SMA is still sloping upwards (2). That’s a perfect mean- reversion setup!

- BUT in the example on the right, you can see that by the time the retracement has come to an end (3) the SMA is already sloping downwards. This is a bad mean reversion setup you should avoid.

So that the SMA50 is still sloping upwards at the moment of entry is of the essence!!

I determine the timing of my entry using my 7-step system.

More in-depth information about how I determine my entries in the Pro Course!

EMA15

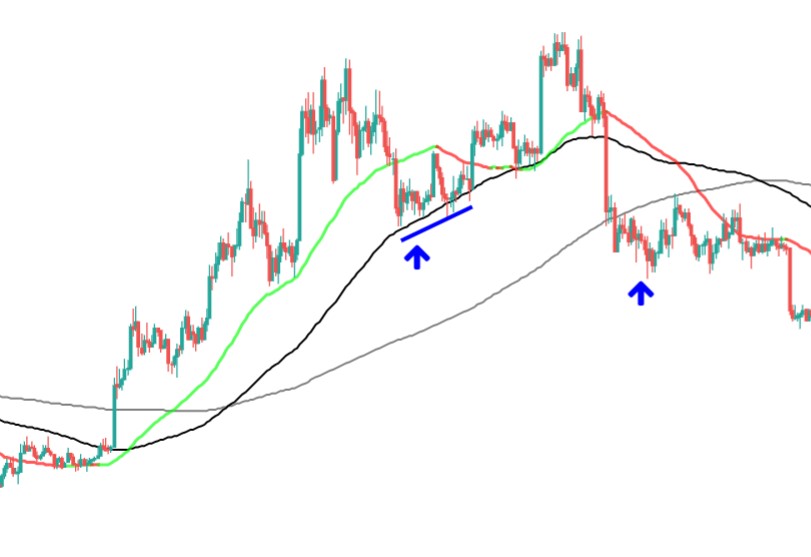

The chart below illustrates how the EMA15 (orange line) often acts as resistance.

You see price drops below an upsloping SMA50, this respects our mean-reversion rules, BUT soon the EMA15 also drops below the SMA50 and holds price down. So my rule of thumb is to target your exit just below the EMA15. I use that as take profit level in 90% of these trades.

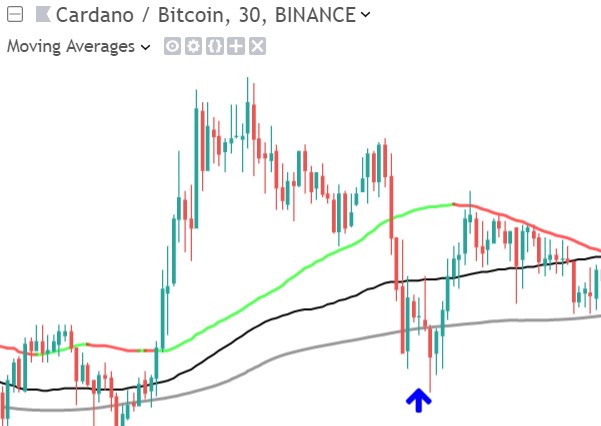

Btw. This is a trade I just made, this is what mean-reversions are all about:

Stricter Rules

Next to this you also have difference in strength and probability between mean-reversion setups. The best mean-reversion setups often have:

- a fast price drop below the SMA

- a steep SMA slope

Not only the SMA, but as I have shown you the EMA15 also plays a big role in the behaviour of the mean-reversion:

(green line = SMA50, orange line = EMA15)

This led me to some extra conditions, in order to find the premium mean-reversion opportunities:

- I prefer a big fast drop below the SMA50.

- While the EMA15 is (well) above the SMA50.

- And the SMA50 has a very steep upwards angle.

This doesn’t mean that my earlier basic conditions (price below SMA, and SMA sloping up) are no longer valid. This is just to know the difference in higher and lower probability mean-reversion setups.

A simple example that meets these new conditions:

When EMA15 is below the SMA50, at the moment you enter, it is a lower probability trade and doesn’t always give you a good bounce. It often bounces to the EMA15:

That’s also the reason I put my TP just below the EMA15 most of the time.

And if it does bounce beyond the EMA15, chances are still high it will remain below the SMA50, as it will more often get exhausted:

Below is a chart where you can compare both these setups. An example of the difference between a higher and lower probability mean-reversion setup.

Quickfingers Luc

As many of you know I am a big fan of Quickfingers Luc. He was a big inspiration for me as a Crypto Trader and as a person.

There are some similarities between QFL’s trades and my mean-reversion trades.

Just like in QFL’s trades, in my mean-reversion trades you also have the highest probability in case of a fast panic drop below the support. Moving averages, and especially the SMA50 behave as support in uptrends (and resistance in downtrends).

In QFL’s trades you look for the strongest supports (bases), and in my trades I look for the strongest supports also. Let me explain.

Moving averages are considered to be dynamic supports. And the steeper the slope of the SMA50, the stronger its uptrend support. So by aiming for the steepest moving average slope, I am actually looking for the strongest moving average support. So the main difference with QFL, is that I use dynamic support zones.

But this doesn’t mean I don’t use support zones. S/R zones should be at the center of any trading method. S/R zones and chart structures are actually the most important element in my trading method. Always know the story of the chart 🙂

SMA100 and SMA200

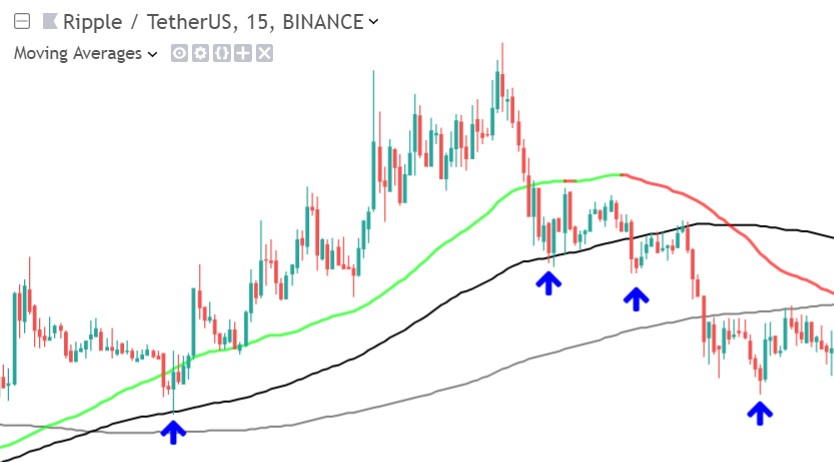

Next to the SMA50, the SMA100 and SMA200 are also very important. When I am trading mean-reversions on a 1 hour chart with the SMA50, then I also have the SMA100 and SMA200 plotted on the same chart. Always keep this in mind when trading mean-reversion setups on a 1 hour chart:

On a 1h chart, the SMA100 represents the SMA50 of the 2h chart

On a 1h chart, the SMA200 represents the SMA50 of the 4h chart.

Besides that many traders consider the SMA100 and 200 as very important supports and resistances, and always keep an eye on them. So do we.

On the next chart example you can see how you can get mean-reversion opportunities on multiple period SMA’s on the same chart.

- At the left blue arrow you see price breaking below an upsloping SMA50, a mean-reversion setup. It finds support at the SMA100 level. This is what I see quite often, when price breaks below the SMA50, then the SMA100 is often the next support, and when it breaks below the SMA100, then the SMA200 is often the next support it respects.

- At the second blue arrow, you see that price broke below an upsloping SMA200: This is also a mean reversion setup! Next it neatly returned to the SMA200-mean again.

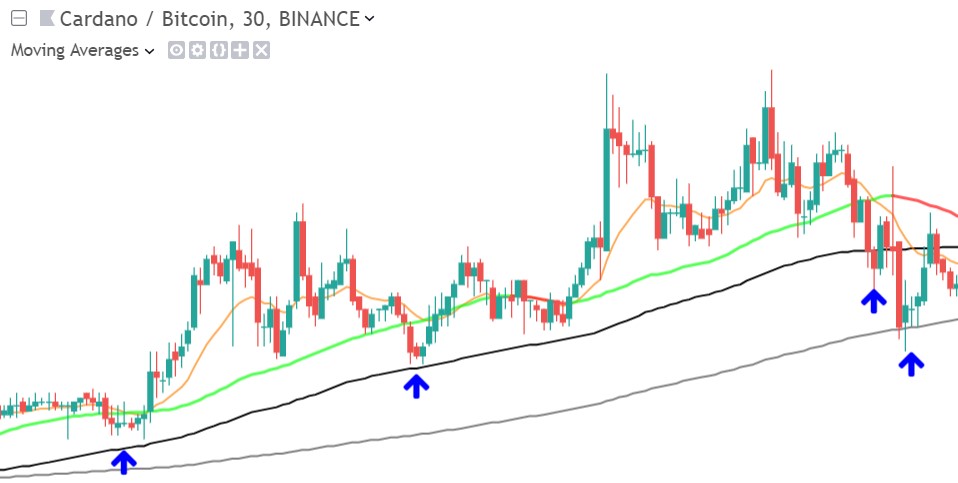

- At the left arrow you see a “normal” mean-reversion, price breaks below an upsloping SMA50, it respects the SMA100 as support.

- The second arrow you see a mean-reversion of the SMA100, and price respected the SMA200 as support. Meanwhile the SMA50 is already sloping down: already later in the trend – upward momentum is losing steam, price didn’t manage to make a higher high.

- At the third arrow we get a mean-reversion setup of the SMA200. Although it still returned to the mean, now the SMA50 and SMA100 are both sloping down. You can clearly see we got a complex ABC retrace, confirming the end of the trend.

And another example:

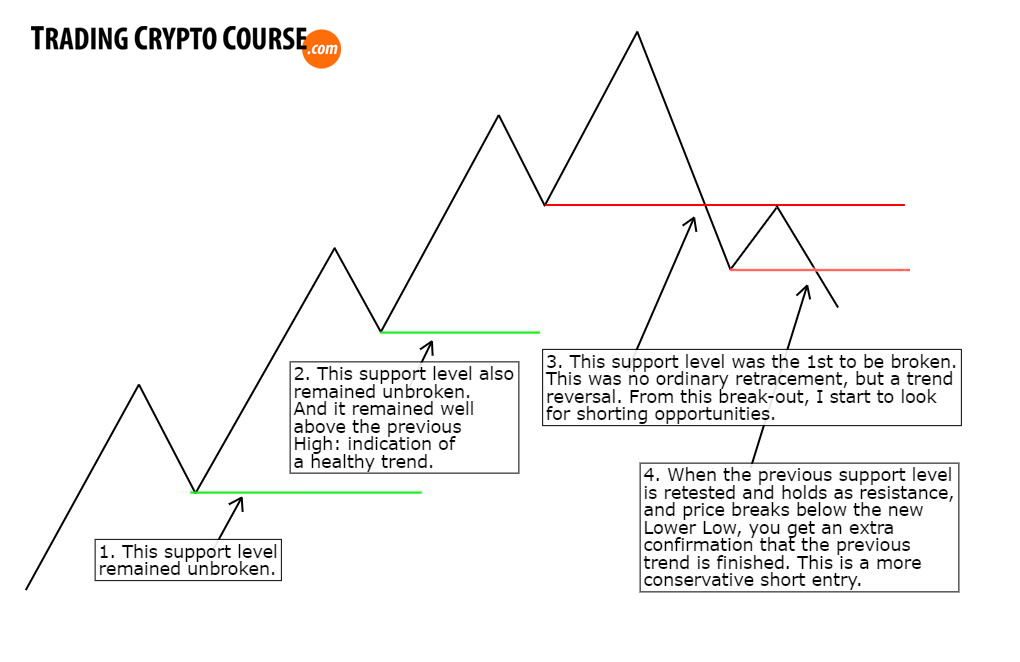

Nice Retracement or Dangerous Reversal?

One of the most important issues with trading mean-reversion setups, is that the retracement your are using as an entry, could actually turn into a trend reversal.

So the most important question I always ask myself: Is this a retracement or a reversal? I would like to show you 2 important chart pattern examples:

Next I have added a SMA50 (50 period simple moving average) to the same chart. This shows me 2 mean-reversion opportunities. This chart is meant to show you that mean-reversion setups late in a trend are very dangerous, and often result in a trend reversal.

You see that using only the slope of the SMA50 as indication of the trend can be dangerous if used without proper reading of the structures on the chart.

Avoid Late Trends

So the conclusion is that chart patterns are very important when trading mean-reversions. Because when there is a divergence between the slope of the SMA50 and what the structures on the chart tell you, then it could be a reversal instead of a retracement, and a VERY DANGEROUS mean-reversion setup.

But it could be an excellent trend reversal signal: in the above example a perfect short entry. This is why I see mean-reversion trades as being inextricably linked with trend-trading. More about trend-trading in the Pro Course!

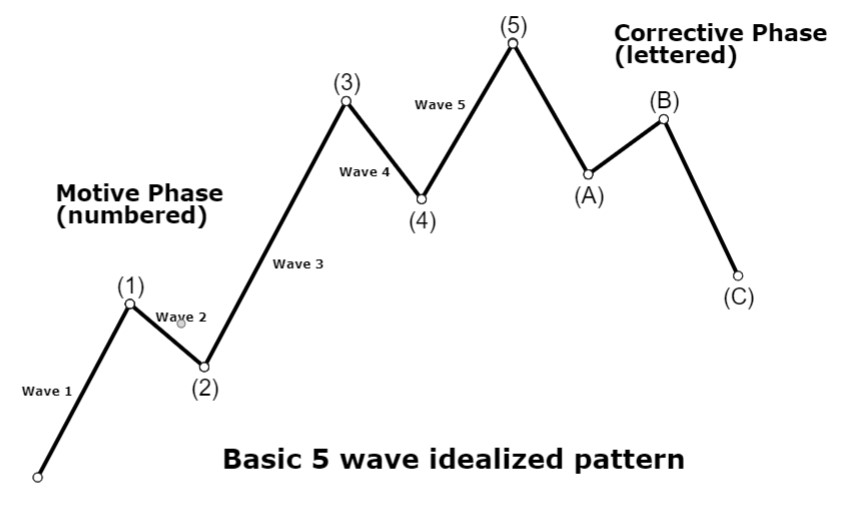

When you are already late in a trend (after 3 waves up), you should be more careful about these mean-reversion setups, as I already mentioned in the previous paragraph. A drop below the SMA50 will more often be in the form of a complex abc retrace. Based on Elliott waves I use this template as how the average trend looks:

The trend often consists of 3 cycles, after those the probability for trend continuation is lower and retraces will be more often complex abc retraces.

I trade mostly on an 1 hour chart, and for the higher timeframe confirmation I often use a 4 hour chart. My base currency is BTC, and when the market is down I try to move to USD.

Trade Examples

Successful mean-reversion trades are trades that returned upwards to the Mean (ema15 or sma50), while the Mean was still above entry level (break-even).

Congratulations!

You are now ready for my final gift to you in this Mini-Course, my Free Scanner:

This Scanner is programmed to find possible early mean-reversion opportunities on Binance.

Use the strategy from this Mini-Course to find the best entries.

For higher precision entry strategies please consider the Pro Course*.

The scanner signals are not entry signals**

Enjoy!

P.s. if you have any question about this trading strategy, or about the scanner, please ask! You can use the live chatbox in the bottom-right corner, or leave me a message on the contact page.

** The Scanner scans the Binance Exchange for these amazing mean-reversion opportunities.

It scans for mean-reversions based upon the SMA50, SMA100 and SMA200, on the 1H timeframe.

It alerts you when price is below an upsloping SMA. But you still need the right skills to get the most out of these signals. Skills YOU have largely mastered by now.

The scanner is based upon a Tradingview indicator script. Pro Course students can download this Tradingview indicator on the indicator page.

The scanner doesn’t give trading or investment advise, as nothing in this website constitutes financial advice.

The content on this website is only about how I read charts using technical analysis.

Please trade and invest responsibly and do your research with due diligence.