In this chapter I will also show you how to use the free position size calculator. You do not need to download, it is available online!

Many experienced traders say that profitable trading is not only about finding the best trades, but also about proper Risk Management. Some even go so far to say that profitable trading is only about Risk Management. Some even call it the holy grail…

In my experience you can’t be a good trader without proper Risk Management.

But before we take an in-depth look into this matter, make sure you have studied the introduction lesson about Risk Management Basics.

Let’s start with the most used risk management terms:

- Entry = price at which your order is executed

- Position Size = number of coins you buy or sell

- Capital = your total account balance

- Stop Loss = order to close a losing position and prevent further losses

- Risk Amount = Capital you lose in a trade if your stop-loss gets triggered.

If you want to max. risk 1% of your Capital in a trade, this is: 0.01 * Capital

Often new traders overestimate the importance of their trading method at the expense of risk management. But your trading method can only bring you so far. As we know the market can do anything at any time. There is always the possibility of a news event we couldn’t predict at all. So no trading method can guarantee a 100% win-rate. That’s why proper risk management is just as important.

Stop-loss

In case it has been a while since you studied the Risk Management Basics lesson, let me first refresh your memory about stop-loss orders a bit:

Traders use stop-loss (SL) orders to exit their position when price hits a level “where the market has turned against them”. SL orders help you to keep your losses small. It has to be at that technical level where the reason you entered the trade is no longer valid.

When entering a trade, you determine your SL location through technicals, like:

- moving averages

- support levels

- retraces/ swing lows

At the same time you should be very careful for stop-huntings/ fake-outs. In chapter 3 Chart Structures Part 2 you already learned about this, and how to avoid this.

What is most important is that when you enter a trade, you believe in it for a reason. Because you saw a particular price pattern. So when price action turns out to behave differently, then your reasoning to be in the trade lost its validity. So:

When price violates the exact reason you entered the trade, is the signal to exit the trade.

Let me explain with an example.

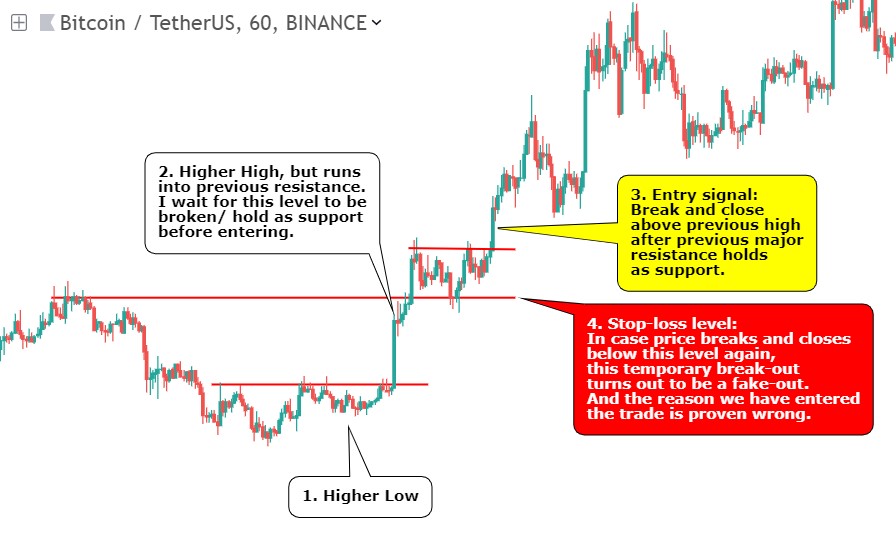

In this example, I show you a chart where the entry is determined only by chart structures, like S/R levels and higher highs/ lows:

The above example is still too conservative for many traders, as price is still making a higher low at the SL level, so technically the uptrend is not yet finished.

This shows that SL placement also depends on your personal risk appetite.

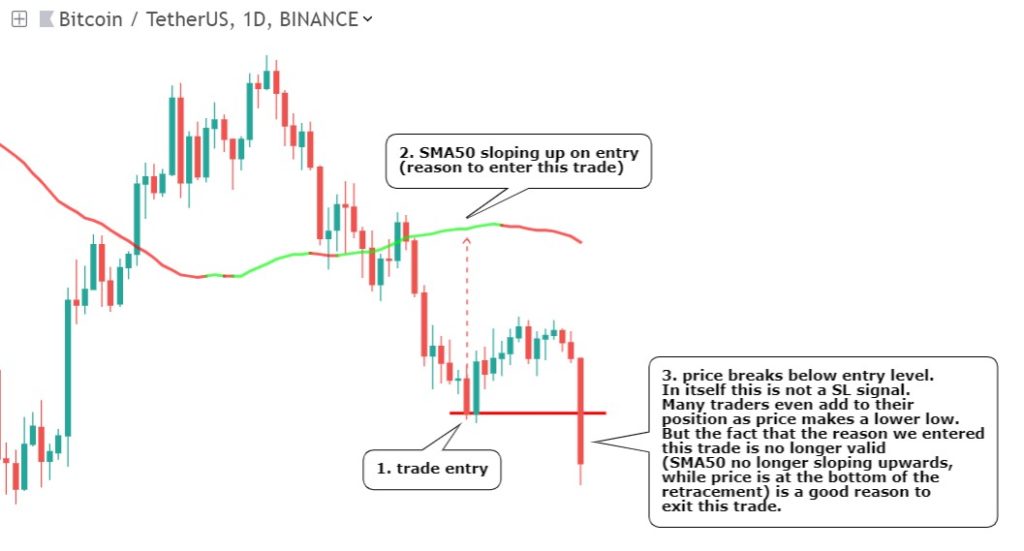

Let me show you another example, this time my favourite mean-reversion trade (more about these trades in the next bonus chapter).

I enter these trades based on many conditions, but let me simplify this to 2 conditions:

- Price retraces below an upsloping SMA50

- The SMA50 is still sloping upwards on entry

(we try to enter at the bottom of the retracement)

You see price breaks below our entry, creating a lower low. and of course it could still turn into a profitable trade, if price decides to return upwards towards the SMA50. But the bottom of this retracement turned out to be below our entry level. And while it broke below our entry level, the SMA50 was already sloping down. So this violated our second entry condition:

The SMA50 should still be sloping upwards on entry at the bottom of the retracement.

So in retrospect we could say we entered too early. Adding to this position (as price broke lower) was not an option, as this lower low didn’t met our conditions anymore.

Position Size

Risk management actually refers to a wide range of different things. Let’s start with position size. Risk management and position sizing go hand in hand.

Like most novice traders, as a new trader I used to trade with the same size in every trade I made. This eventually results in risking too much of your total account in a wrong trade, and wiping out many previous winning trades.

As a trader we need to practice Money Management. we need to manage our money (our entire account/ total trading capital). Good money management means:

You only risk a fixed percentage (of your total account) in each trade.

Most professional traders only risk a maximum of 1.5% to 3% of their total capital.

Your risk (the money you could lose) per trade is determined by where you place your stop-loss. Let me explain with an example:

- Total account capital = $ 1,000

- Max. allowed risk amount per trade: 1.5% of capital = 0.015 * $ 1,000 = $ 15

- position size = 10 coins at $ 10 = $ 100

- Stop-loss level not lower than: ($ 100 – $ 15) ÷ 10 coins = $ 8.5

As you see, the position size, your total capital, and the SL level are all tightly connected. When you decrease the distance to the SL, then your allowed position size increases. So a tighter SL, gives you a bigger position size for the same risk amount.

All this is to ensure that you never exceed the maximum allowed risk over your total capital in a single trade.

As a pro trader, you:

- First determine the SL level based on TA

- Next determine your position size: how many coins you can afford to buy, based upon your total capital and the maximum allowed risk %

Another example:

- Coin price on entry = $ 10

- TA Stop-loss level = $ 8

- Total account capital = $ 1,000

- Max. allowed risk amount per trade: 1.5% of total capital = 0.015 * $ 1,000 = $ 15

- What is the max. allowed position size?

Answer:

$ 10 – $ 8 = $ 2 risk per coin

$ 15 ÷ $ 2 = 7.5 coins or $ 15 ÷ 0.2 (risk % in decimals) = $ 75

(if 7.5 coins hit SL, then the total loss is $ 15)

I use the following position-size formula:

Nr of coins = (max allowed % risk per trade x capital) ÷ (entry price – SL price)

Practice this a lot, for a pro trader this should be second nature.

You can practice this by using the following list when planning a trade:

- What is my total account capital? $1,000.

- What % of my account do I want to risk? 2%. ($1,000 x 0.02 = $20)

- What is my entry price? $10

- What is my stop-loss price? $8

- What is my position size? $20/$2 = 10 coins

Or you can use this Position Size Calculator I have built for this:

Position Size Calculator

Trading with Leverage

Margin trading allows you to borrow money against your current capital, to trade cryptocurrency.

So you don’t use your capital to trade crypto directly, but indirectly. You use your capital to borrow even more money. So you can buy a bigger position with less money. This is why it is also called leveraged trading.

“Liquidation” happens when the losses on your position exceed the capital you used to borrow that position.

That’s why you lose that capital on liquidation. So when you use ALL of your capital to borrow money against, then you also lose all of your capital on liquidation.

Leveraged trading can increase your losses. If you want to make sense of leveraged trading, then your allowed position size is indispensable information. But leveraged trading doesn’t influence your position size at all though. In leveraged trading your position size is also based upon the stop-loss price. Not on your liquidation price!

The leverage you apply doesn’t influence your position size.

- For example, if you buy 1 Bitcoin at 10x leverage, that doesn’t mean that your position size has increased to 10 Bitcoins.

The position size calculator is also a great tool to keep your risk under control

when you trade with leverage.

Casino’s and Risk Management

For a professional trader it is very important to remember, maybe even repeat like a mantra, this quote from Warren Buffett:

“Anything can happen anytime in markets.”

As we have seen in this lecture, this uncertainty must be taken seriously. The crypto market, and also the stock market, any market actually, is basically like a casino. Many unexperienced novice crypto traders are high on “hopium”, and their trading career is a mere gamble. They “fomo” into trades only to panic out of them next.

The reason many new traders blow up their accounts is because of bad risk-reward (RR) ratios combined with losing streaks. They take big risks for small rewards and to “repair” that damage they take even bigger risks. But for every percentage that you lose, you need an even bigger percentage to recover, like illustrated below:

| % Drawdown | % gain required to recoup losses |

|---|---|

| 10 | 11.11 |

| 20 | 25.00 |

| 30 | 42.85 |

| 40 | 66.66 |

| 50 | 100 |

| 60 | 150 |

| 70 | 233 |

| 80 | 400 |

| 90 | 900 |

| 100 | busted |

So if you lost 50% of your account in the last trade, you now need a reward of 100% in the next trade to only break-even. And you even need a reward 9 times bigger than that, if you lost 90% in the previous trade.

So besides a healthy RR ratio, you should never risk a too large portion of your account in each trade. That is what the first part of lecture was all about.

But how do professional traders stay in the game in such an unpredictable market? Just like how a casino stays in the game, in a business based on a game of chance. For example, many people think that the roulette is a 50/50 game.

But in reality the casino has a small advantage. The roulette wheel has 18 red number, 18 black numbers, BUT also 2 green numbers! Anytime it hits the green numbers the casino wins. So in reality it is not a 50/50 game, but the casino has a small advantage. Out of the total 38 numbers, the player can win by 18 numbers, the casino by 20 numbers:

- Casino win-chance: 20/38 = 52.63%

- Player win-chance: 18/38 = 47.37%

This shows you the casino has a 5.3% advantage over the player. This means that the casino statistically wins $52,600 for every million dollar that is bet.

This shows us that the casino’s are in this for the long run. They don’t mind losing bets, even a lot of bets, because in the long run they win the most bets.

So even with a low win-rate like that, winning 52.63% of the bets, the casino’s manage to build all this in the long run:

This is exactly what professional traders know. Next to having high win-rate trading methods, they are used to manage risks like casino’s.

In this course you learned my 7-step method to get the trades with the highest probability. This is our advantage over the market, These are our lucky green numbers 🙂

So it is not about winning most of your trades. It is about finding your advantage. Like the casino’s with their 52.63% win-rate (roulette). And next managing risks to keep you in the game for the long run, compounding profits over time.

Risk and Reward

As explained in the Risk Management Basics lesson, the Risk Reward Ratio is very important.

Although I don’t base my SL (and take-profit) on a fixed risk/ reward ratio, and let the market determine what I will do, I use a 1:1 RR ratio as bottom-line. So for every $1 I risk, I want to win at least $1. I never enter a trade where I can potentially win less than I can lose. I actually prefer a 1:2 RR ratio.

The reason I like trend trading is because when you get in early in a new trend you have potentially a very nice RR ratio. You can potentially ride the whole trend, a very big percentage reward, compared to the relative small percentage risk, of hitting your SL.

This is a popular rule: Big Wins & Small Losses = Profitability.

Experienced traders know this, keep your losses small, and let your winners run.

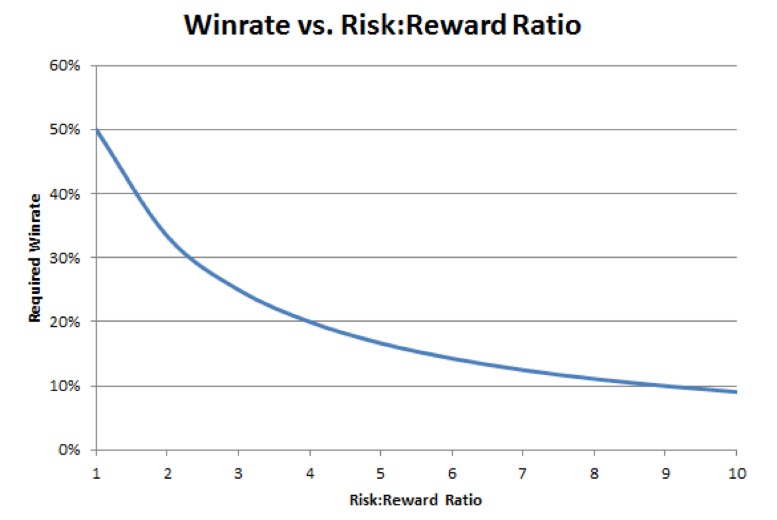

This has to do with statistics, as illustrated in this graph:

As you see, the higher the RR ratio, the lower the required Winrate to break-even! For example: when RR ratio is 9, then you break-even after winning only 10% of your trades. So when you win 50% of your trades, that means 40% is pure profit. Imagine if you win 70% of your trades with such a RR ratio. The next tabel shows you some exact numbers:

| Risk | Reward | Breakeven Win Rate% |

|---|---|---|

| 50 | 1 | 98% |

| 10 | 1 | 91% |

| 5 | 1 | 83% |

| 3 | 1 | 75% |

| 2 | 1 | 67% |

| 1 | 1 | 50% |

| 1 | 2 | 33% |

| 1 | 3 | 25% |

| 1 | 5 | 17% |

| 1 | 10 | 9% |

| 1 | 50 | 2% |

This is very important to grasp:

Imagine you take very much risk for very small potential profit, a RR of 50:1.

Then you need to win 98% of your trades to only break-even!!

But imagine having a high probability strategy, like my mean-reversion

setups. And imagine you can win 5% on each trade, while risking 1%.

Then you would be break-even after 17% of your trades being winners.

So if you lost 83% of your trades you would still break even.

Trade like a casino

As I have tried to show you in this lecture, statistics lets you win in the long run. Even with a low win-rate. Don’t focus too much on single trades, but look at trades as part of a series of trades. Don’t get scared of losing trades, but keep them small. In the short term you might have a losing streak, but in the long term you know you will win, because of your statistical advantage.

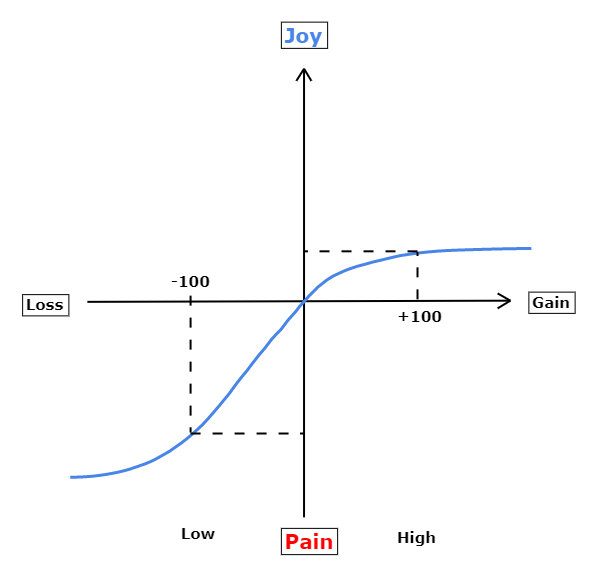

Prospect Theory

Unhealthy risk-reward ratio’s, and holding on to losses is a psychological phenomenon. Most traders have a tendency to avoid losses at all costs. This is also known as “loss-aversion” theory, or “Prospect Theory”. It means that losses tend to have a bigger impact on traders (and people in general), than an equal amount of gain does. When an average trader wins $1.000, this leads to less emotional impact, than when it would have been a $1.000 loss. That’s the reason many traders hold on to their losing trades, and turning them into big losses, as they can’t accept the loss. This obviously creates an unhealthy risk-reward ratio.

How Prospect Theory works is illustrated in the next matrix:

Of course it is nice to have my 7-step trading method, and the mean-reversion strategy with the very high win-rate, like 75%. But it is never a garantee. Remember, “Anything can happen anytime in markets.”

But even when luck turns against you, you get a huge losing streak, and end up with a win-rate of 50%, then you can still be very profitable if you just remember to keep your wins bigger than your losses.

As my trading method is based on Technical indicators, moving averages, volume and other technical analysis, I will give you a Technical Analysis Minicourse in the next 10 free lessons, so that you are well-prepared when enrolling in my Pro trading course.

Or Enroll in the Pro Course & Become a Pro Trader!