In my experience many courses fail because they actually sound more like those dime a dozen motivational self-help books. But what you really need is a practically usable trading method in bite-sized chunks 🙂.

So I will keep this section as pragmatic as possible. Let’s start with some quotes that I think apply very well to trading:

I think it’s very important

to have a feedback loop…

I think that’s the single best piece of advice:

constantly think about how you could be doing things better and questioning yourself.

Elon Musk

Anything can happen anytime in markets.

Market forecasters will fill your ear

but will never fill your wallet.

Warren Buffett

If you want to be a successful trader, you have to rise above your expectations that come from limiting belief systems. Even before you start trading at all, you first have to truly believe that you can do this.

Many people do not believe that they could be a successful trader, or think that the people who did succeed were just lucky.

Whether you believe that you can or can not, you are always right. I used to think that it was nonsense, but it turns out that it is literally true. If you really think that something is impossible, you will not even get out of your seat in order to get started.

But this is not about the power of positive thinking, this is not a new age course. Positive thinking only takes you to the starting line. You can visualize a million dollars and a Lamborghini, but that does not bring you anything. This only works with hard work, discipline and studying. By trial and error.

Give a man a fish and he eats a day.

He starves while waiting for the next free fish.

Teach a man to fish and he will eat a lifetime.

You want to be the pro yourself and not listen to the success stories of the pros all your life. It is an active process, you learn it only by doing it.

You have to lose money and make money and lose it again. It becomes wise through damage and shame, that’s how it works. Nobody can teach you everything you need to know. You have to do it yourself!

Stress

The fact that many traders only make losing trades is put away by many researchers as self-sabotage, you would unconsciously have conflicting ideas that prevent you from trading successfully. I am not a supporter of this hypothesis. I do not believe that traders have an unconscious need to fail. What I do know is that trading is accompanied by stress. Stress ensures that

- You avoid those risky situations that could have yielded the most

- You look for seemingly safe situations that give the least profit

It is important to realize that you can not make a profit without taking risks. That is why so much money is being made and lost in the crypto market, which is one of the most volatile markets. Risk and reward are both sides of the same coin called volatility. So we want volatility, so we can make a profit, but that is accompanied by risk. That is why it is so important that you do risk management.

Stress does not make you think clearly and this can express itself as follows:

- A fight-or-flight response is a natural defense mechanism that occurs in humans and animals when there is danger and is accompanied by anxiety and stress. A third reaction is “freezing”. When trading this occurs as follows. You get out of winning trades too quickly (flight) and you keep the losing trades for too long (freeze). When the “danger” has passed, the body produces dopamine to restore balance. This leaves you with a pleasant feeling of cutting short your winning trades and holding on to your losing trades. This makes it more difficult to improve your behavior.

- Emotions run wild, at the most difficult moments.

- While you try to follow a plan, in reality you are impulsive or passive.

- You wait too long to get in and out of a trade, while your plan did require it from you.

- You impulsively chase opportunities, making you step in too high and get out too low.

- Your trades are desperate as you try to make up for losses.

What goes wrong?

Women often turn out to be better traders than men. Men are hunters by nature. Hunting was accompanied by dopamine, a feel-good neurotransmitter. Research shows that the brain releases more dopamine in anticipation of a reward than when the reward actually comes. This plays a role in the addictive effect of trading and that you can get into a kind of trance. This numbs pain so that traders are less focused on the risks in the present and more on the reward in the future.

Dopamine shots are alternated with dopamine depletion, many traders recognize this in alternating periods of over-self-assurance and depression. It is important to stay on the ground with both feet and to trade in the here and now. Only in the here and now can you learn to avoid mistakes and risks.

And some more inspirational quotes:

Success consists of

going from failure to failure

without loss of enthusiasm.

Winston Churchill

Be humble, no matter

how good a trader you are,

you can never predict what

the market will do next.

You can only try to improve

your odds based on past data.

Be critical, even a broken clock

is right twice a day.

Me

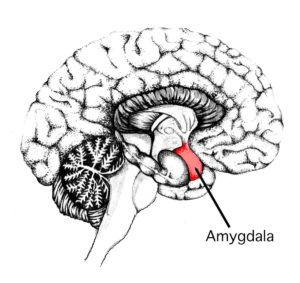

Many traders indicate that they were much better when they first started trading. As they learned more and gained more experience, they were actually getting worse. It could be that new traders are much braver from their naivety. Experienced traders, have learned to trade by making mistakes, mistakes that have caused you pain. Even though you can’t remember the details of those bad experiences, a part of your brain can. The Amygdala stores details about everything you’ve ever hurt, so that you can avoid it in the future. It recognizes patterns, such as faces and therefore patterns on charts. Losses have more impact on Amygdala than profits. This is coupled with fear over time.

So even if you consciously choose a certain trade, unconsciously this can bring fears. So always try to ask yourself: to what extent your final choice matches your original conscious intention.

Or have you been avoiding dangers that weren’t there at all?

Always remember that risk and reward are both sides of the same coin. You do not cover risk by avoiding it, but by controlling it. It is therefore always important that you know how much risk you are willing to risk in a trade and how much potential reward you have, so that you endanger your account as little as possible. You can also unlearn wrong behavior. So make a plan and stick to it. In the next chapter more about risk management.

To stay emotionally balanced, the relationship between pain and reward should not be 50/50. You got to have more positive than negative experiences. If a choice leads to pain as often as to reward, it feels like an arbitrary environment. As if we have no influence at all on the outcome of a trade. This can work in a demoralizing way. You often see that the behavior of traders becomes more random.

What also does not help is that the ideal entry and exit moments are very easy to see in hindsight. This creates the illusion that the past was predictable. But afterwards it is easy to talk.

Always trade with money that you can afford to loose. The fear of losing your own capital feels just as intense for many as losing your life. Simply put, the best traders have no fear. Primitive brain areas are focused on survival and can’t be switched off with the conscious mind. So as soon as losing your capital feels the same as losing your life, these fight, flight and freeze reactions come to the scene. As a result, it may be that you keep a losing trade too long (freeze) or get out of a winning trade quickly (flight). The best way to deal with the unavoidable risks is a trading plan and risk management. Because of this you know in advance where and when you have to get in and out and you will not be overwhelmed by fear and instinctive impulses. Many new traders prefer to avoid ALL losses, which inevitably leads to just that one loss that eventually becomes a huge loss. Starting traders often find it too difficult to admit that they were wrong and stay in a losing trade too long.

Having rules gives you structure in a chaotic market.

It prevents an emotional rollercoaster.

Self-awareness

If people have nothing to do these days, they grab their smartphone, at the traffic light, in the queue in the supermarket, etc. This phenomenon is called “continuous partial attention” (CPA). CPA and FOMO are the new standard, FOMO stands for “Fear Of Missing Out”. A survey by Microsoft showed that the average attention span has fallen from 12 seconds in the year 2000 to only 8 seconds now.

Will human attention become a “scarce commodity” in the future?

That we lack self-awareness expresses itself in the “optimism bias“.

The idea that we are less at risk than others. As with smokers who think they are less likely to get sick than other smokers, or that we think we are less likely to be victim of a crime than others, or traders who think they will suffer less from losses in the market.

In addition, many traders often report their losses as “learning money”, even though they have repeatedly made the same mistakes over a long time. All clear signs of a lack of self-awareness.

As said, the attention span of modern man is getting shorter and shorter. You often see this reflected in traders constantly changing between different tradesystems. They think and hope to automatically run into the best working system. This is a kind of pack behaviour that you see a lot in the market of retail traders, and are therefore also an easier victim of market manipulation. My main tip is: focus. Make sure you focus on 1 system and become as good as possible in it. In my Pro course I teach you my trading system.

Keep a logbook

Be honest with yourself, be aware of pitfalls such as:

- The “optimism bias”

- Flight or freeze reactions

- The role of stress and dopamine

My second tip is therefore to keep a logbook. Write down after each trade what you have traded, why you traded it, what went right and wrong and whether there is room for improvement. It seems boring and useless, but you will see that you become much more aware of your trades and it will become easier to improve through this self-reflection.

One of the most important things I have learned over the years, is that making mistakes is good. Embrace your losses. Learn from them. This is where growth starts. This is an evolutionary approach. By facing your mistakes and losses, you evolve yourself.

66 days

Scientists say that it only takes 66 days to change your life, IF you are strong enough. According to Charles Duhigg, author of ‘The Power of Habit’, habits are not nature, but nurture. Research shows that the average time it takes for participants to learn a new habit was 66 days. What is still difficult at first, feels like a habit after 66 days, without you having to think much about it.

Give yourself at least 66 days time to make a method your own, put it on your calendar if necessary.

But before you can do it yourself, you will first have to learn the fundamentals of a trading method. That’s exactly what I have got for you in my Pro Course.

In the next free lesson I will focus on Risk Management, I think this is a subject each trader should encounter very early in their trading career.

Or Enroll in the Pro Course & Become a Pro Trader!