Support and Resistances are horizontal price levels that prevent the price of a coin from rising or falling. These static barriers are the most popular forms of support and resistance. Many times however, the price of a coin will trend up or down and price will tend to respect a diagonal and linear level which is identified as a trendline. That’s why I have connected the swing highs and lows by the purple lines in this example:

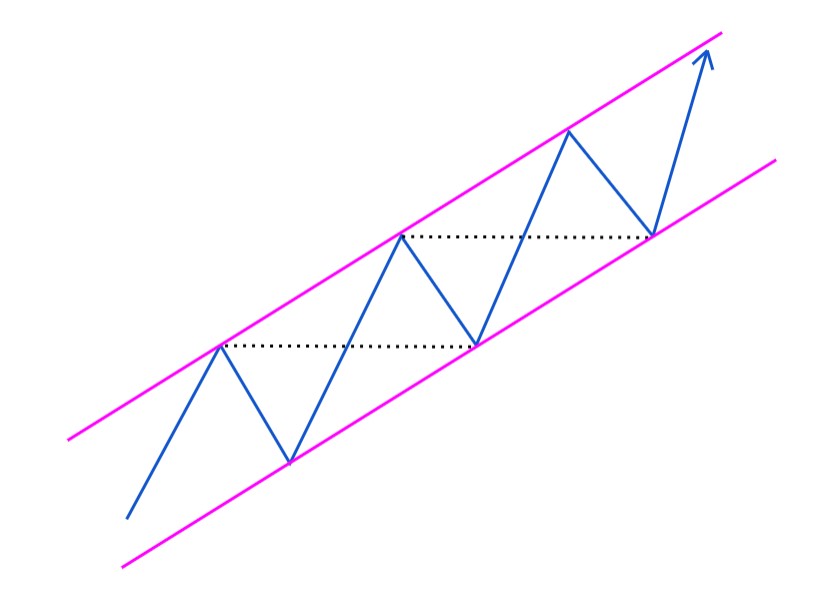

The blue line represents price, the dashed black lines represent support and resistance lines (zones), and the pink lines are trendlines.

In this simplified example the trendlines form a “parallel channel”. These trendlines are another way to catch the start of an impulsive wave.

- Uptrends will tend to create a trendline that acts as a support level

- Downtrends will tend to create a trendline that acts as a resistance level

To draw a trendline, you will need to find at least 2 minimum swing highs and lows, and connect them with eachother. Some more conservative traders even say you need at least 3 swing points to draw a trendline. Never force a trend line, because in order for it to be a reliable trendline, it must be obvious for other traders too. Technical Analysis if mostly about the self-fulfilling property of obvious patterns, as they are spotted by many traders.

There is no absolute way to draw trendlines. It is up to the trader himself to determine which prices he connects. Some traders only connect the closing prices of the candles. Others use a mix of open, close, high and low prices. The more prices the trendline touches, the more reliable the line probably is.

Don’t use smaller timeframes to draw your trendlines, I always use the 1 hour chart and higher. Whether a coin trends upward or downward often differs per timeframe. On a 1 hour timeframe, a coin can have an uptrend, while it has a downtrend on, for example, the daily chart.

When trading, always keep an eye on the dominant direction of the trend on a higher timeframe, you do not want to trade against the trend, but want to use it to your advantage. That is also much more forgiving when a trade turns against you, when trading with the trend you will more often get a second chance.

So always zoom out a bit before you make a trade, to know where you are. Try to see the bigger picture.

An important (often overlooked) property of trendlines, is their angle. A steep slope means a strong trend. A small angle means the trend is weak.

Not all trends start with a big price jump. Early trends often have a small slope.

An increase in the slope of a trendline, signals an increase in momentum (strength). And vice versa, a decreasing slope means decreasing momentum.

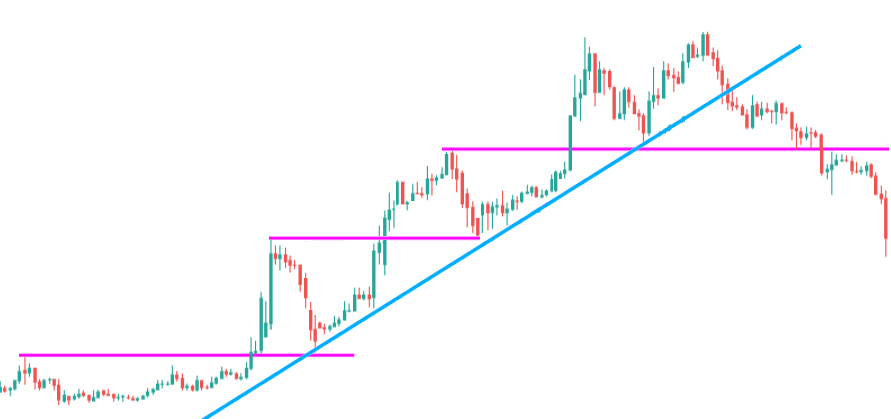

Now you now, that when the market makes a series of higher highs and higher lows, you can say that the market is trending up. And when the market makes a series of lower highs and lows, it’s trending down. But it is said that markets only trend 30% of the time. Most of the time they are ranging, Ranging markets are also called sideways markets, their indecisive nature makes them move horizontally.

Buyers and sellers keep moving price between a horizontal support and resistance level, until one of them “wins” and price breaks out of its channel, as you can see in this example.

In channels you often see that the volume is lower, especially in the middle of the channel. Breakouts are often accompanied by increase in volume. If the volume does not increase during a breakout, this is sometimes a sign of a false breakout, often the channel is continued.

Knowing whether you are in a trending or ranging market is very important, as you can then decide which strategies you can use to trade it.

- In a trending market we try to buy at the end of a retracement/ the start of a new impulse wave.

- In ranging markets the best buying and selling opportunities occur at the support and resistance levels that form the range.

In my experience trendtrading is more reliable, as sideways markets lack momentum in a particular direction and can therefore breakout of the range at any time. Trends have momentum in a particular direction, especially early trends. As a trendtrader I do watch ranging sideways markets all the time, as a breakout of these indicates the beginning of a new trend most of the time.

As I said in the previous chapter, Moving Average’s can also act as support and resistance levels. But contrary to normal supports and resistances, Moving Averages are dynamic, they change their position on the chart continuously. Hence they are called “dynamic” support or resistance. Here an example with a 50 period MA

The same applies for moving averages as for trendlines: the steeper the slope, the more momentum (strength). So as a trend trader you want to see a steep angle of the moving average.

In my successful trading system these moving averages play a very important role. More about that in my Pro Course.

In summary I can say that I prefer trending markets as these are much more reliable to trade. An uptrend indicates that the bulls are in control and a downtrend that the bears are in control. However, prices do not trend forever and as the balance between the bulls and bears changes, the chart often shows us a clear pattern.

In the next chapter I will show you some of the most used chart patterns.

Or Enroll in the Pro Course & Become a Pro Trader!