Many new traders are not aware of the importance and power of Risk Management in any trading method. Risk and reward are very tightly connected. And as we trade to make nice rewards, we should also be aware of the risks and how to manage these.

Stop-Loss

Traders use stop-loss (SL) orders to exit their position when price hits a level “where the market has turned against them”. SL orders help you to keep your losses small. So it has to be at that technical level where the reason you entered the trade is no longer valid.

When going long, you can base your SL location on:

- a moving average

- a support level

- a retrace/ swing low

What is most important is that when you enter a trade, you believe in it for a reason. Because you saw a particular price pattern. So when price action turns out to behave differently, then your reasoning to be in the trade lost its validity. So:

When price violates the exact reason you entered the trade, is the signal to exit the trade.

For example: price bounces off a support level (while the 50 period Moving Average is sloping up), confirming an early uptrend, and you entered the trade based off that reason. Subsequently price nonetheless does break below that support level, thus violating the reason you entered the trade in the first place.

Hard and Soft Stop-Loss

Many traders use a “soft” SL: they first wait for price to violate the reason to be in that trade, before they place the stop order manually.

I prefer to use a “hard” SL: you determine in advance at what price your original reason to enter the trade will be violated (where you will be proven wrong), and at that price you place a SL order as soon as you enter the position.

Hard stops are very important to me. When the reason I am in a trade is no longer valid, I want to get out as soon as possible, or else I would be gambling.

Win-rate and Risk-Reward ratio

Although I don’t base my SL (and take-profit) on a fixed risk/ reward ratio, and let the market determine what I will do, I do use a 1:1 RR ratio as bottomline. So for every $1 I risk, I want to win at least $1. I never enter a trade where I can potentially win less than I can lose.

The reason I like trendtrading is because when you get in early in a new trend you have potentially a very nice RR ratio. You can potentially ride the whole trend, a very big percentage reward, compared to the relative small percentage risk, of hitting your SL (just below the SMA50 for example).

This is a popular rule: Big Wins & Small Losses = Profitability.

Experienced traders know this, keep your losers small, and let your winners run.

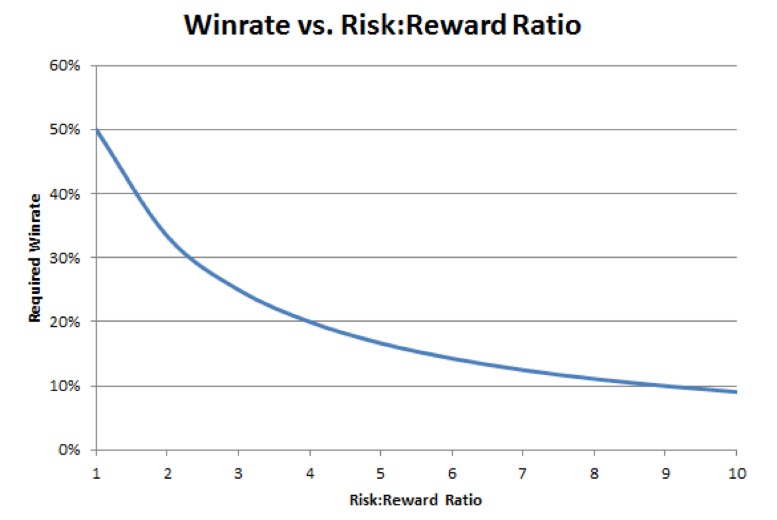

This has to do with statistics, as illustrated in this graph:

As you see, the higher the RR ratio, the lower the required Winrate to break-even! For example: when RR ratio is 9, then you break-even after winning only 10% of your trades. So when you win 50% of your trades, that means 40% is pure profit. Imagine if you win 70% of your trades with such a RR ratio. The next tabel shows you some exact numbers:

| Risk | Reward | Breakeven Win Rate% |

|---|---|---|

| 50 | 1 | 98% |

| 10 | 1 | 91% |

| 5 | 1 | 83% |

| 3 | 1 | 75% |

| 2 | 1 | 67% |

| 1 | 1 | 50% |

| 1 | 2 | 33% |

| 1 | 3 | 25% |

| 1 | 5 | 17% |

| 1 | 10 | 9% |

| 1 | 50 | 2% |

This is very important to grasp:

Imagine you take very much risk for very small potential profit, a RR of 50:1. Then you need to win 98% of your trades to only break-even!!

But imagine having a high probability strategy, like my KISS mean-reversion setups. And imagine you can win 5% on each trade, while risking 1%. Then you would be break-even after 17% of your trades being winners. So if you lost 83% of your trades you would still break even.

The reason many new traders blow up their accounts is because of bad RR ratios combined with losing streaks. They take big risks for small rewards and to “repair” that damage they take even bigger risks. But for every percentage that you lose, you need an even bigger percentage to recover, like illustrated below:

| % Drawdown | % gain required to recoup losses |

|---|---|

| 10 | 11.11 |

| 20 | 25.00 |

| 30 | 42.85 |

| 40 | 66.66 |

| 50 | 100 |

| 60 | 150 |

| 70 | 233 |

| 80 | 400 |

| 90 | 900 |

| 100 | busted |

So if you lost 50% of your account in the last trade, you now need a reward of 100% in the next trade to only break-even. And you even need a reward 9 times bigger than that, if you lost 90% in the previous trade.

So besides a healthy RR ratio, you should never risk a too large portion of your account in each trade. I never risk a large percentage of my account on each trade. This way I can survive losing streaks. Determine a percentage of your account you are willing to risk per trade and per day, week, month, etc.

Or Enroll in the Pro Course & Become a Pro Trader!